Originally published at: https://discgolf.ultiworld.com/2023/12/13/2023-fandom-survey-fan-relation-to-discs/

This article is part of a series that will be released throughout the offseason based on the 2023 Ultiworld Disc Golf / StatMando Fandom Survey. If you wish to learn more about the survey and the demographics of the survey respondents, please read this accompanying article.

Disc golf is an incredibly unique sport in that the equipment we use to compete is variable and personalized for each athlete. MLB, NBA, and NFL games are each played with standardized balls regulated directly by the league. There isn’t a large market for signature series basketballs or footballs which have, for instance, a Bruins stamp on them, as these are not what the professionals actually compete with. The discs that professional disc golfers use, however, can be from any range of manufacturers, and be personalized for the individual player through special stamps, custom dyes and sometimes even sharpie drawings from friends. Because of this, a major driving force of the disc golf economy is the discs themselves, which come in a seemingly endless combination of molds, colors, plastics and stamps. In this article, we will cover the disc-purchasing habits of the survey respondents and look to see what affects these habits, including which professional disc golfers drive disc golf sales the most.

First, we asked survey respondents how many discs they currently owned.

- The largest percentage of respondents own between 26-50 discs (19.2%), which is roughly a completely filled bag with up to a full set of back-ups.

- Roughly 21% of respondents indicated they owned more than 200 discs. 4.4% of respondents indicated they owned over 500 discs!

Next we asked survey respondents about their recent disc golf purchases by asking how many discs they had purchased over the past 12-month period.

2023 Discs 12-Month Percentage

- Roughly half of respondents indicated they had purchased between six and 20 discs in the past 12 months, which averages out to roughly one disc per month.

- The highest option available for selection by respondents was 31+ discs (> 2.5 discs/month) which nearly 500 respondents (16%) selected. We will include an even higher option in subsequent surveys to better parse out these super-purchasers.

How do the highest disc purchasers differ from the average survey respondent? We compared the 493 respondents who purchased over 30 discs (referred to as “super-buyers” for the remainder of the article) in the past 12 months with the overall survey results and found that:

- The favorite manufacturer does not vary drastically among this group of super-buyers compared to the average. Innova, MVP and Discraft remain the top 3 favorite manufacturers with the order unchanged from the average survey respondent. Discmania saw the largest bump, with 16% of super-buyers favoring this manufacturer compared to just 11% for the overall survey.

- The favorite MPO player of the super-buyers also does not drastically deviate from the average survey respondent. Simon Lizotte, Calvin Heimburg, and Paul McBeth remained as the top three favorite players and the order is unchanged from the average survey respondent. Gannon Buhr saw the largest bump, polling at 2.4% for favorite player among all respondents and 5.3% among super-buyers.

- Super-buyers were far more likely to be an active PDGA member (82%) than the average survey respondent (65%).

- Super-buyers were more likely to consume disc golf media by watching the live broadcast (48%) compared to the average survey respondent (38%). Unsurprisingly, they also indicated they followed both MPO and FPO broadcasts more closely than the average respondent.

- Finally, super-buyers were far more likely to play disc golf daily (22% compared to 9%) or more than once per week (53% compared to 44%) when compared to the average survey respondent. This strong connection between how often one plays disc golf and how many discs they purchase can be visualized here:

Above we look at the intersections of the questions: “How often did you play disc golf in the last year?” and “How many discs have you bought in the last 12 months?” Each column of the heatmap represents the percentage of respondents for each category of playing frequency who purchased differing numbers of discs (columns sum to 100%).

- For example, over half of the respondents who answered that they only played a few times in the last year bought 1-5 discs, but across survey respondents, just over 17% identified they had purchased 1-5 discs in the last month.

- The heatmap trending from top left to bottom right shows a strong correlation between disc purchasing and frequency of playing. Over 40% of the players who indicated they played daily were in the super-buyer group, purchasing over 30 discs in the past 12 months.

Despite the recent growth in the purses of PDGA and DGPT events, professional disc golfers often require the support of sponsorship deals. Currently, the most lucrative of such sponsorships are with disc golf manufacturers. As a part of these sponsorships, disc golf manufacturers often sell special discs affiliated with their sponsored players, including signature series discs and tour series discs. Here, we asked survey respondents if they had ever purchased a tour/signature series disc for an array of professional disc golfers. From a pre-selected list of top-touring professionals, respondents could select as many answers as they wished (Note: for this survey question, all players included in the Fandom section of the survey were included except: Anthony Barela, Aaron Gossage, Emerson Keith, Sai Ananda, and Jessica Weese. These players were accidentally excluded in the list of selectable answers and have been excluded from all subsequent analysis). 2,891 respondents filled out this question, of which 212 (7.3%) indicated they had never purchased a player’s signature series disc.

- Paul McBeth had the highest percentage (54.2%), with over half of the respondents indicating they have purchased a tour/signature series disc of his. It is unsurprising that McBeth, who has over a decade of dominance in the sport including six World Championships, leads this category. However, it is still worth noting how successful McBeth has been in translating his on-the-course triumphs to disc sales across multiple manufacturers.

- Simon Lizotte (50.3%) also comes in with over half of respondents purchasing at least one of his tour/signature series discs. McBeth and Lizotte have thoroughly separated themselves from the rest of the field in this category, with over a 12% gap between 2nd and 3rd place.

- Notably, 3 of the top 5 professionals on this list (McBeth, Wysocki and Heimburg) have at one point had their name on the Innova Destroyer, one of the most popular distance drivers of all time.

- Paige Pierce leads the FPO field (32.6%) narrowly beating out the recent Major grand-slam winner Kristin Tattar (29.0%). These two FPO players have a substantial (>18%) lead over the next FPO player, Hailey King at 11.4%.

- Importantly, this question does not distinguish a fan who purchased one tour/signature series disc of a player from a fan who purchased over 20 tour/signature series discs for a single player.

These results are heavily influenced by the length of time the professional disc golfers have been touring. To better gauge recent trends, we asked survey respondents which discs they purchased in the last 12 months. 2,600 respondents answered this question, of which 382 (14.7%) indicated they had not bought any tour/signature series discs of the listed individuals within the last 12 months. In addition to the number of respondents, the rank within each players’ specific manufacturer for the 2023 season is viewable by hovering over a specific column.

- With 40.15% of respondents purchasing his tour/signature series disc in 2023, Simon Lizotte dominates this category, with nearly twice as many respondents as any other player. Potentially fueled by the transition of his primary sponsorship shifting from Discmania to MVP in early 2023, respondents had the opportunity to purchase tour series discs from both manufacturers in the last 12 months. Lizotte has clearly shown the ability to translate his recent DGPT victories and popular YouTube channel (almost 200,000 subscribers at time of writing) to disc sales.

- Kristin Tattar and Paige Pierce remain the two FPO players with highest sales among respondents, but Tattar has a clear edge over the last 12 months, with nearly 2.5 times more respondents indicating they purchased her tour/signature series discs compared to Pierce.

- Despite being ranked 5th and 6th highest in overall fandom scores, Matthew Orum and Ohn Scoggins both fall below 5% of respondents purchasing their tour/signature series discs. Conversely, despite being ranked 45th out of 57 players in average fandom score, Ricky Wysocki is still easily in the top 10 in recent tour/signature series disc sales among respondents. Together these highlight how an average fandom score is not necessarily representative of how marketable a player is.

- Players sponsored by Prodigy had a fantastic season on the course. Isaac Robinson and Gannon Buhr finished 2nd and 3rd respectively in MPO Player of the Year voting. Players sponsored by Prodigy collectively won two Majors, four Elite and four Silver events this season, with a large number of additional podium finishes. Despite this, their highest ranked player on this list for recent tour/signature disc sales is Isaac Robinson in 15th. Is it possible that Prodigy’s low manufacturer fandom score (4.11) is contributing to lower disc sales of its top talent?

- There are some players who have been actively partnering with manufacturers in recent years to generate their own line of discs for that manufacturer, such as Kevin Jones (Prodigy) and Drew Gibson (Finish Line distributed by Infinite Discs). Both of these players scored incredibly low in this survey question (2.9% and 1.6% respectively). These surprisingly low numbers may be due to the wording of the question, as a player’s line of discs may not be considered their tour/signature series discs. We hope to clarify this point in future surveys.

The fandom of survey respondents for each player undoubtedly affects the likelihood of them purchasing a tour/signature series disc for that player. Which touring professionals do best at turning high fandom scores into disc sales? To gauge this, we looked at all respondents who gave a player the highest possible fandom score (10) and asked what percentage of them ended up purchasing a tour/signature series disc for that player in the past 12 months. This is a metric to show how well players and manufacturers can channel fandom for that player into disc sales. You can mouse over any column to see the sample size (number of respondents who gave this player a Fandom score of 10) as well as the change in percentage of respondents buying that player’s disc relative to the entire group (data from the last graph). Note: only players who were included in both the fandom survey and the disc purchasing questions were included in this analysis.

- It should come as no surprise, but every single player had a higher percentage of respondents purchasing their discs when looking at the subset of respondents who gave them a 10 on the fandom scale, relative to the whole group average.

- Paul McBeth and Simon Lizotte again lead this category, with nearly half of respondents who rated them a 10 on the fandom survey purchasing their discs in the past 12 months.

- Four players had greater than a 20% increase in the percentage of respondents buying their tour/signature series discs when looking at this subset of respondents: Ricky Wysocki (+24.0%), Brodie Smith (+22.2%), Eagle McMahon (+21.4%), and Paul McBeth (+20.8%). These four players clearly do a fantastic job at marketing to their most enthusiastic fans.

- Interestingly, the 6th highest increase by this metric was seen by Natalie Ryan (+19.0%) who, despite having under 100 respondents give her a 10 on the Fandom score, saw 20% of these respondents purchase her tour series discs. Players with a small but passionate fanbase are potentially well-positioned to see increases in their disc sales if their fanbases expand. Other examples of players with low disc sales (<5% of respondents) but much higher disc sales among their biggest fans (>15% of respondents) include Isaac Robinson, Niklas Anttila, Ezra Aderhold, and Maria Oliva.

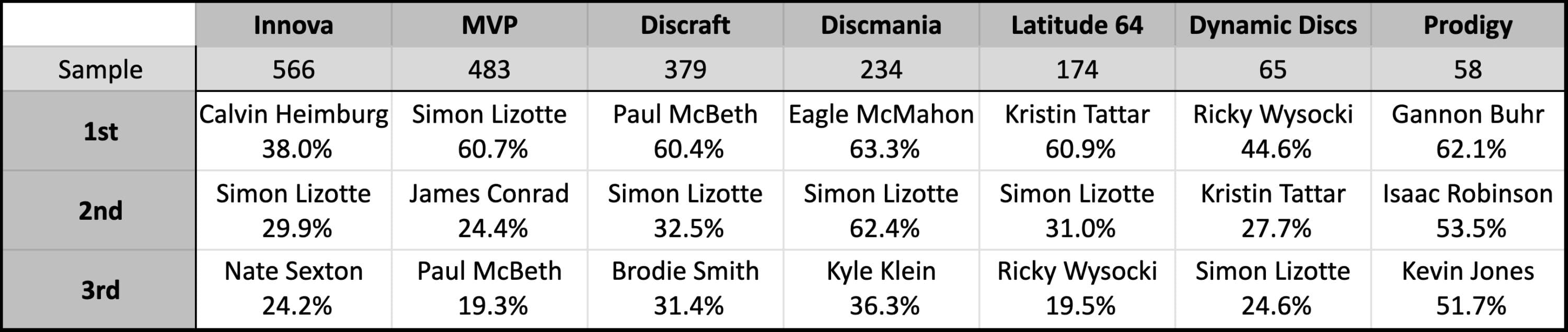

- The number one disc-seller amongst a manufacturer’s fanbase is a sponsored player of that manufacturer for all seven companies calculated above. Eagle McMahon, Gannon Buhr, Kristin Tattar, Simon Lizotte and Paul McBeth all see over 60% of respondents who favor their primary manufacturer purchasing their tour/signature series disc in the last 12 months.

- The prolific selling power of Simon Lizotte is on display here with him being in the top three sellers for six of the above seven manufacturers! For survey respondents who indicated Innova was their favorite manufacturer, only Calvin Heimburg had a higher percentage of respondents purchasing his discs than Lizotte. Similarly, Simon also ranked second for fans of Discraft, Latitude 64 and Discmania. Prodigy was the only sponsor that did not see him in the top three positions, with Prodigy fans having a great variety of different MPO players to support.

- The cross-manufacturer marketing of the Trilogy family is on display with Ricky Wysocki and Kristin Tattar both in the top three for Dynamic Discs and Latitude 64. Kristin Tattar was also second (behind Matthew Orum) among fans of Westside.

Thank you for reading this piece in our series of articles analyzing the results of the 2023 Fandom Survey. Collectively, these data highlight the array of factors that impact disc purchasing of the Fandom survey respondents. Which of these results surprised you most? What additional information pertaining to disc purchasing would you be interested in being analyzed in the following years?

I would like to thank Jesse Weisz for his leadership and assistance with this piece as well as the rest of the StatMando team. Special thanks to Karl Lamothe, the editor of this series. Once again, if you wish to be notified when next year’s survey is ready or want to be emailed when survey results are released, please enter your email address here. If you are interested in being involved in the survey and have experience in polling or a profession related to studying surveys, please get in touch with us at [email protected].

Please see the full series of 2023 articles by following these links:

- The Survey Itself & Who Took It

- Which Pros Do We Root For and Against

- How Fans Feel about Disc Manufacturers

- Fan Relation to Discs

- How Fans Feel about Media and Commentators: Coming This Offseason

- How Fans Feel about Courses: Coming This Offseason

- More Findings From The Fandom Survey: Coming This Offseason

Links for the 2022 Fandom Series articles can be found here.