Originally published at: https://discgolf.ultiworld.com/2023/11/28/2023-fandom-survey-how-fans-feel-about-disc-manufacturers/

This article is part of a series which will be released throughout the offseason based on the 2023 Ultiworld Disc Golf / StatMando Fandom Survey. If you wish to learn more about the survey and the demographics of the survey respondents, please read this accompanying article.

Disc golfers are passionate about the discs they throw and the manufacturers who make them. This article shares some of the data collected through the Fandom Survey on disc manufacturers. Note the word “manufacturer” is used loosely here, as many of the companies covered don’t physically produce their own discs. Nevertheless, we’ll use the word manufacturer, but are really referring to disc brands.

We asked survey participants how they felt about nine different disc manufacturers on a 10-point scale, where a score of 0 was considered a maximum “dislike” and 10 was considered a maximum “love.” The Fandom Scores below are the average of the scores given by the 3,040 survey respondents.

2023 Average Manufacturer Fandom Score

- MVP showed a sizeable lead on the competition, which is certainly tied to having the most popular MPO player in the world, Simon Lizotte. It is reasonable to speculate MVP would not have been #1 if we’d included this section of questions in the 2022 survey. But would Discmania be ranked higher if Lizotte hadn’t left?

- The two biggest manufacturers, Innova and Discraft, nearly tied in Fandom Score.

- Paul McBeth is the marquee player on Discraft, yet he had a lower average Fandom Score (6.66) than the company. Discraft’s highest-profile FPO player, Paige Pierce, also had a lower average Fandom Score (5.89) than the company. Other marquee players with lower average Fandom Scores than their sponsor included Catrina Allen (DGA) and Nikko Locastro (Lone Star). On the other hand, Lizotte (MVP), Kristin Tattar (Latitude 64), Calvin Heimburg (Innova), Gannon Buhr/Isaac Robinson (Prodigy), and Ricky Wysocki (Dynamic Discs) are all top players with average Fandom Scores that exceeded their manufacturer’s score.

- Prodigy and Lone Star had average Fandom Scores well below all the other manufacturers. What would Prodigy’s popularity have looked like before the Buhr contract dispute? How about Lone Star before they tried to make everyone and their dog a sponsored player and were still running the immensely popular (but confusing) “Run Ricky Run” commercials? We’ll never know, but moving forward we plan on asking these manufacturer questions annually to gain a long-term view of this changing landscape.

Here is the distribution of respondent scores for each manufacturer represented as percentages of the total number of responses:

2023 Percentage Manufacturers Fandom Score Spread

- Innova and Discraft had remarkably similar score distributions. Innova had slightly more respondents giving it top scores between 8 and 10, but also more respondents giving it poor scores between 0 and 3. Discraft scores were less polarizing, but amazingly, their scores average out to be the same up to the first decimal point.

- DGA stretched out the y-axis with a lot of 5s. Despite being the oldest company in the sport (founded in 1976), many respondents may not know of DGA. It might come as a surprise that DGA received a higher percentage of low scores than manufacturers like Innova and Discraft, who one may have expected to be more polarizing.

- MVP had the fewest low scores (0-3).

Preference gaps for “Home” locations for several manufacturers are presented in the chart below (some manufacturers have several homes). A preference gap is the difference between the average Fandom Score from a particular segment of respondents and the average of all 3,040 respondents. Positive values indicate the focal fan segment gave higher Fandom Scores than the total respondent average. Negative scores mean the opposite.

State/Country Manufacturer Preference Gaps

- Preference gaps are maximized when manufacturers have relatively low average Fandom Scores across survey respondents. For example, Kansans gave Dynamic Discs a lukewarm average Fandom Score of 6.92, but this is significantly higher than the average score given to Dynamic Discs across all survey respondents (5.26), making this the largest hometown preference gap. Like most of our charts, you can see more data by mousing over each bar (or touching them on a touchscreen).

- Prodigy, based in Georgia, had the second-largest hometown preference gap. Prodigy has a reputation for being a strong brand in the southern United States; they also had sizeable preference gaps from Tennesseans and South Carolinians. Surprisingly, there was only a small hometown preference gap for Prodigy in Finland, where Seppo Paju and his family have worked to grow the sport, including running a professional tournament series.

- In contrast, Discmania had quite a large home preference gap in Finland. Perhaps Jussi Meresma’s efforts in growing the sport in Finland, including hosting the European Open, were appreciated more than Prodigy’s efforts. It was not public knowledge that Discmania had been purchased by House of Discs when our survey was conducted. In Sweden, where Discmania discs are actually manufactured, respondents had a negative preference gap, meaning Swedish respondents liked Discmania less than the average respondent. This could be due to a Swedish-Finnish national sports rivalry. Discmania also had a substantial positive preference gap in their United States residence, Colorado.

- Latitude 64 had high preference gaps in both their home in Sweden and their neighbor Finland, so maybe that negates the Swedish/Finnish rivalry theory. This could be an example of overall European favoritism for the brand or Latitude 64 making more of an effort to penetrate both the Finnish and Swedish markets.

- Innova has a West headquarters in California and an East headquarters in Rock Hill, South Carolina, right across the border from Charlotte, North Carolina. In California, Innova has a positive hometown preference gap, but in South/North Carolina there is minimal preference gap relative to the average respondent, surprising given their many years of sponsoring the USDGC.

- Conversely, MVP is a brand associated with the MVP Open in Massachusetts and local resident Simon Lizotte. The preference gap for MVP in Massachusetts was nearly twice as large as the gap for them in Michigan, where MVP is located.

- While Lone Star is still disliked in Texas (4.58), Texans don’t dislike them as much as the average respondent (3.58).

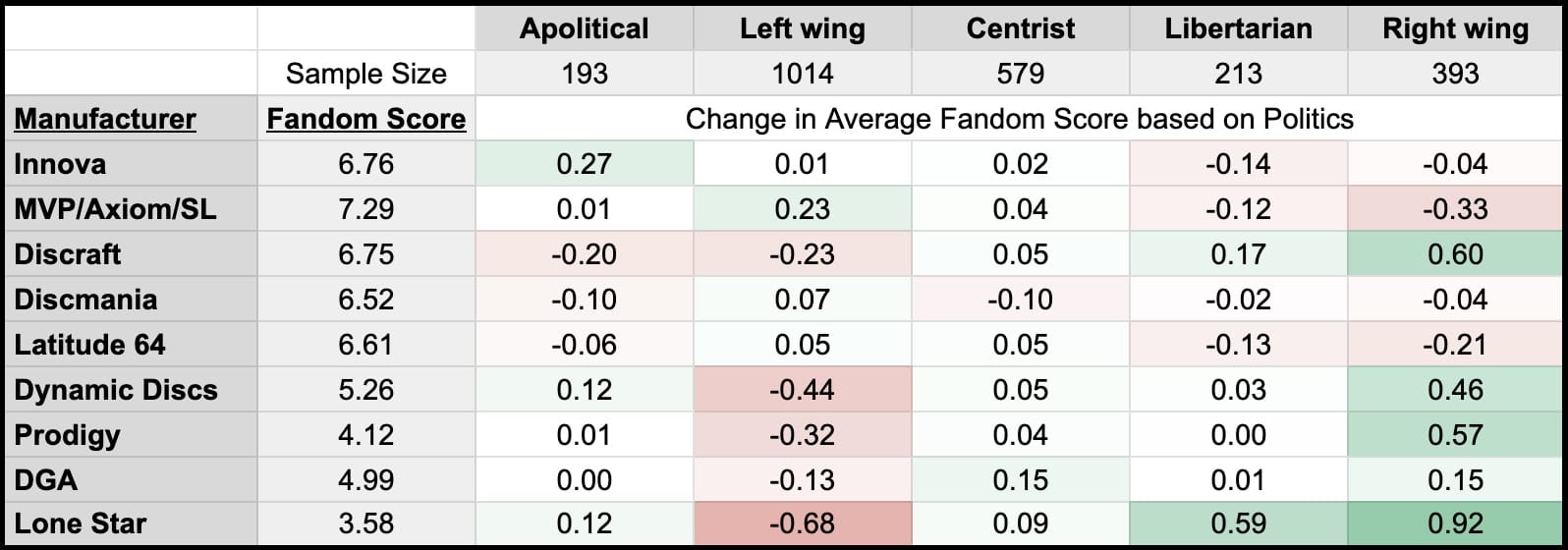

In addition to investigating Fandom Scores for disc manufacturers broadly, we can evaluate scores based on participant demographics. Below is a table with a heat map showing how participants with different political viewpoints scored disc manufacturers. The average Fandom Score across participants for each manufacturer is presented in the second column. The average Fandom Score in each cell is only from respondents who answered the other survey question being analyzed. As some respondents didn’t answer every question, the average Fandom Scores in the heatmap may vary slightly from the overall Fandom Scores reported here and in other articles.

The cells in the remaining columns show the preference gap for the focal fan segment being considered. Positive preference gaps are in green, with darker shades representing larger preference gaps. Negative preference gaps are represented in shades of red. The smaller the preference gap, the closer it will be to white.

- Left-wing respondents gave MVP the largest positive preference gap, whereas they gave several brands significant negative preference gaps. Left-wing respondents showed the largest negative gap toward Lone Star, followed by Dynamic Discs, Prodigy, and Discraft.

- Right-wing respondents gave Lone Star the largest positive preference gap, which is unsurprising after seeing their negative gap with left-wing respondents. As expected, these right-wing gaps look like the inverse of the left-wing gaps. The gaps were generally larger, but the large sample size of the left-wing respondents may have contributed to having smaller changes from the average.

- Libertarians, who in US politics mostly vote alongside the right-wing, had smaller gaps than right-wing respondents but leaned in the same direction.

- Survey respondents who indicated they were centrist or apolitical showed very few deviations from average respondents. It is interesting to note that more strongly leaning in either direction on the political spectrum intersects strongly with manufacturer fandom.

- Remember that our overall pool of respondents leaned left-wing. The result is manufacturers who are liked more by left-wing respondents had an advantage in Fandom Score over companies with a right-wing preference.

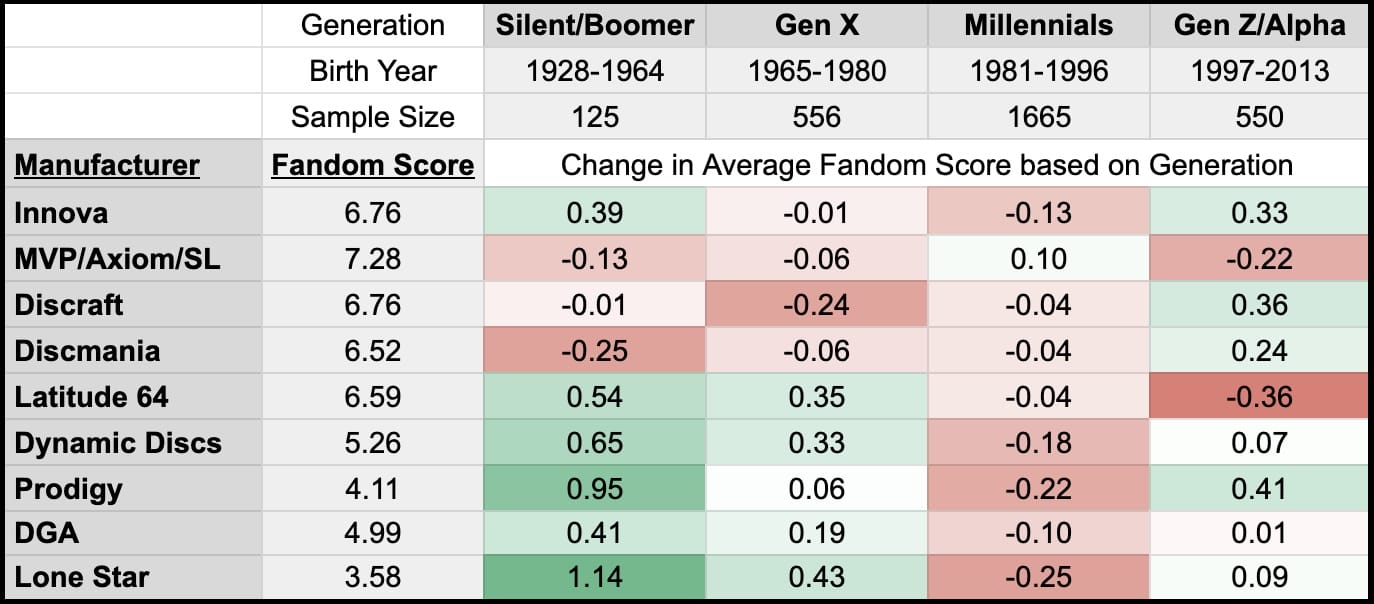

Next, we’ll look at how Fandom Scores for disc manufacturers differed across respondent age groups.

- The survey had more millennial respondents than all other generations combined, which caused their preference gaps to be relatively small. Nevertheless, that does not account for why millennials gave below-average Fandom Scores to all manufacturers besides MVP. It seems as if they are less generous with their scoring than other respondents regarding manufacturers. In a future article, we will see if this extended to their judgment of professional disc golfers.

- I expected MVP would also have a positive preference gap with Gen Z/Alpha, but they didn’t. In fact, this was MVP’s worst generation gap. Nevertheless, they still received a respectable Fandom Score of 7.06. Gen Z also had a negative preference gap for Latitude 64. Gen Z/Alpha’s highest preference gap was for Prodigy. Perhaps this has something to do with Alden Harris’ YouTube channel?

- As we mentioned earlier, Innova and Discraft had nearly identical Fandom Scores, so seeing where they diverged can be interesting. Both Silent/Boomer and Gen X respondents preferred Innova to Discraft, with the opposite for Millennial and Gen Z/Alpha respondents.

- Interestingly, Innova received their highest scores from the oldest and youngest respondents.

- Discmania seemed to be more popular with younger respondents and Latitude 64 more popular with older respondents.

- Silent/Boomer respondents were the most generous with their scoring of the manufacturers. They gave the largest positive preference gaps of any generation to six of the nine manufacturers.

We had over twice as many respondents in 2023 compared to 2022, but the source of respondents can still be a big factor given our current sample size of disc golf fans. Below are the preference gaps based on where respondents indicated they found out about our survey.

- Many, if not most, respondents likely follow more than one of these media sources, so there is inherently a blurry line between these segments.

- The respondents who found out about the survey from Foundation gave Discraft the largest positive preference gap overall. This makes sense as Foundation started off as a Paul McBeth-backed company and Brodie Smith maintains part-ownership, both of whom are Discraft-sponsored players. If Foundation had not promoted this survey, Innova would surely have separated itself from Discraft in terms of overall Fandom Score.

- The largest negative preference gap came from Redditers expressing their dislike of Lone Star. Redditors might be more clued into controversies and instances of bad customer service. This may also have to do with the political preferences of our sample size that came through Reddit.

- Redditors liked MVP the most. MVP’s marketing director, Andrew Johnson, confirmed they do enjoy interacting with fans on Reddit and have put resources into using r/discgolf as a marketing platform.

- Respondents whose source was either Foundation or the Nick and Matt Show were more generous with their scoring than respondents who found out about the survey from other media sources.

- Ultiworld respondents were more negative than the average respondent for nearly every manufacturer but stayed close to the average overall. This could be because they are the largest source of respondents so most define the average.

We also asked the more straightforward question, “Which company is your favorite disc manufacturer?”

Which company is your favorite disc manufacturer?

- Innova had the most votes for favorite manufacturer. This is not surprising as they’ve been the most dominant brand in the sport for many years (for example, click here for sales information from Infinite Discs, an online disc retail company).

- MVP has rapidly risen from being a small niche manufacturer to one of the most popular brands in the sport. How many respondents chose MVP as their favorite manufacturer because of Lizotte? We can’t know that for sure, but of the 552 respondents who chose MVP as their favorite manufacturer, 48% (265 respondents) chose Lizotte as their favorite player.

- Thirty different brands were chosen as favorites. Ten of these companies weren’t “making” discs five years ago. It will be interesting to see how many of these companies are still in business five years from now and whether there is room for another large manufacturer to emerge.

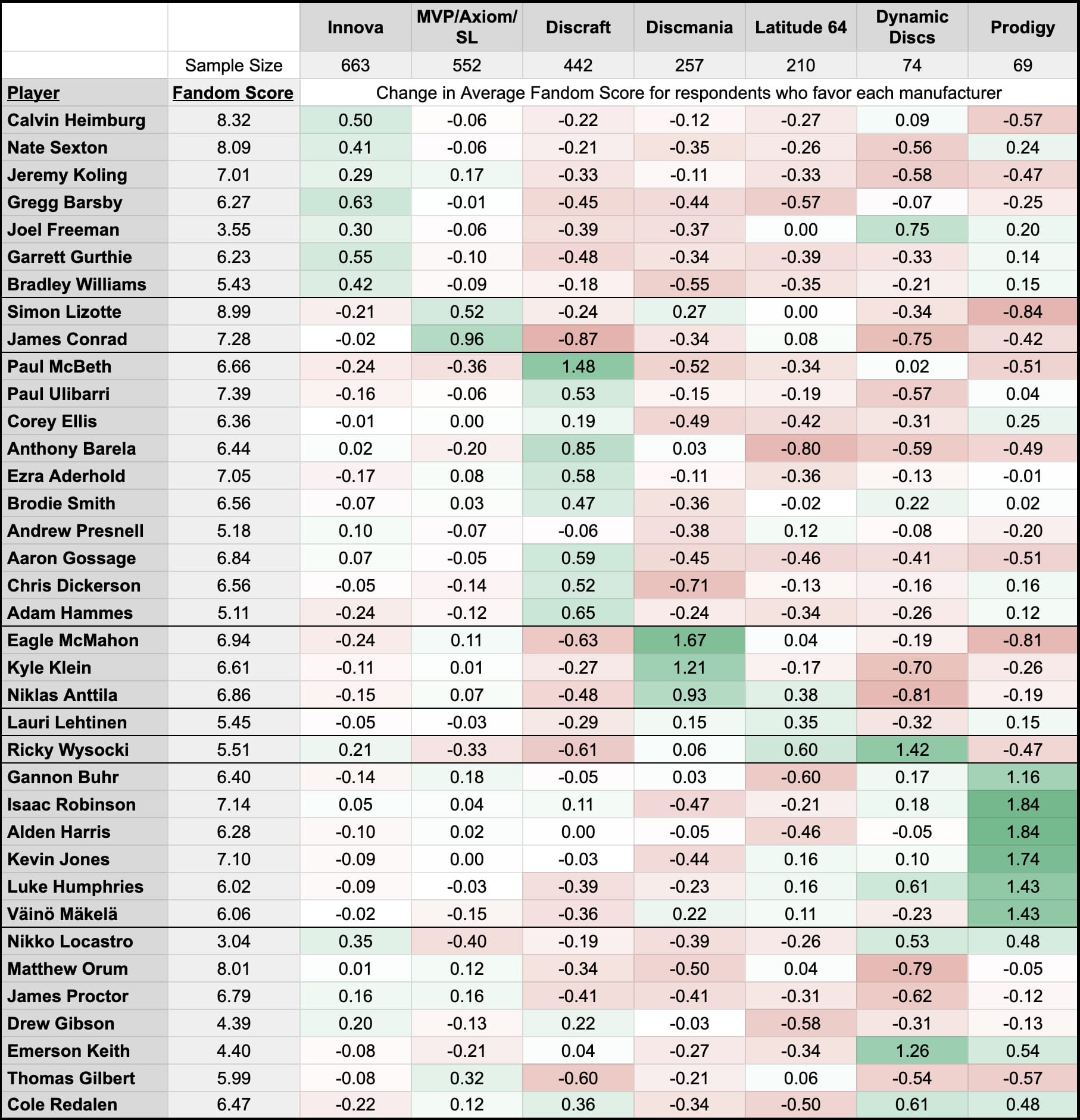

The next two heat maps show how average Player Fandom Score differed among respondents with different favorite manufacturers, a potentially useful tool when considering future player sponsorships. The first map displays MPO competitors and the second displays FPO competitors. All players have been grouped by their sponsoring manufacturer at the time that the survey was taken. The players at the bottom were not sponsored by any of the manufacturers we featured in this table.

- There is a positive correlation between the preference gaps of respondents and the player’s sponsor. This can be seen in the green chunks of cells along the diagonal from top-left to bottom-right.

- Buhr is considered by many to be the best MPO free agent this summer. An example of using the data above is House of Discs, owner of several brands including Latitude 64, Dynamic Discs, and now Discmania, could choose to sign Buhr to a brand that gives him the best preference gap. In this case, that would be Dynamic Discs. Their biggest MPO hole however is at Latitude 64 where Buhr has a significant negative preference gap. Another way of seeing this is Buhr could draw in new fans who otherwise were not interested in Latitude 64.

- Despite trying to leave Prodigy at the beginning of the season, and at of the time of writing seemingly poised to leave, Buhr still received a large positive preference gap from Prodigy fans. The Prodigy-sponsored players all had very large positive preference gaps with Prodigy fans. Isaac Robinson and Alden Harris tied at 1.84 for the largest preference gap of any player in the survey. Prodigy had the smallest sample size of the manufacturers, so that means fewer of their fans driving up the average whole pool Fandom Score. Innova had smaller preference gaps due to having the largest sample size and therefore influence on the overall average.

- Players who are already popular to begin with had less room for improvement, so their positive preference gaps for their sponsor are pretty minor. Really popular players like Lizotte and Heimburg had modest preference gaps with their sponsors’ fans. The same could be said for very unpopular players and negative preference gaps.

- Many players have moved sponsors throughout their careers. This does not result in a consistent pattern of post-parting feelings. Fans of Ricky Wysocki’s former sponsors still give him better than average Fandom Scores. The same goes for Lizotte with Discmania. Dynamic Discs fans still give Emerson Keith a large preference gap even though he left them for Lone Star.

- McBeth had a negative preference gap with fans of his previous sponsor, Innova. In fact, McBeth had negative preference gaps with nearly every manufacturer’s fans. As a result, the average Fandom Score for McBeth is held up by fans of Discraft. This trend is not unique to McBeth, as most players have negative preference gaps with nearly all manufacturers’ fans other than their sponsors’.

- Joel Freeman’s preference gap with Dynamic Discs fans is 150% larger than his preference gap with fans of his sponsor, Innova.

- One preference gap that jumps out is the 0.19 that Corey Ellis received from Discraft fans. He won a Major this season before polling began and Discraft fans still don’t passionately root for him.

- An extreme case of low preference gaps is Andrew Presnell, who is the only player in both MPO and FPO with a negative preference gap with his sponsor’s fans.

- For players with relatively low preference gaps from fans of their sponsor, it begs the question of whether this should inform sponsorship actions taken in the future. Perhaps specific individuals are a bad fit for the manufacturer’s fanbase. Perhaps the manufacturer hasn’t done a great job of promoting the individual. Or maybe the player hasn’t done a great job of promoting themselves, which seems to be where the onus for publicity typically lies.

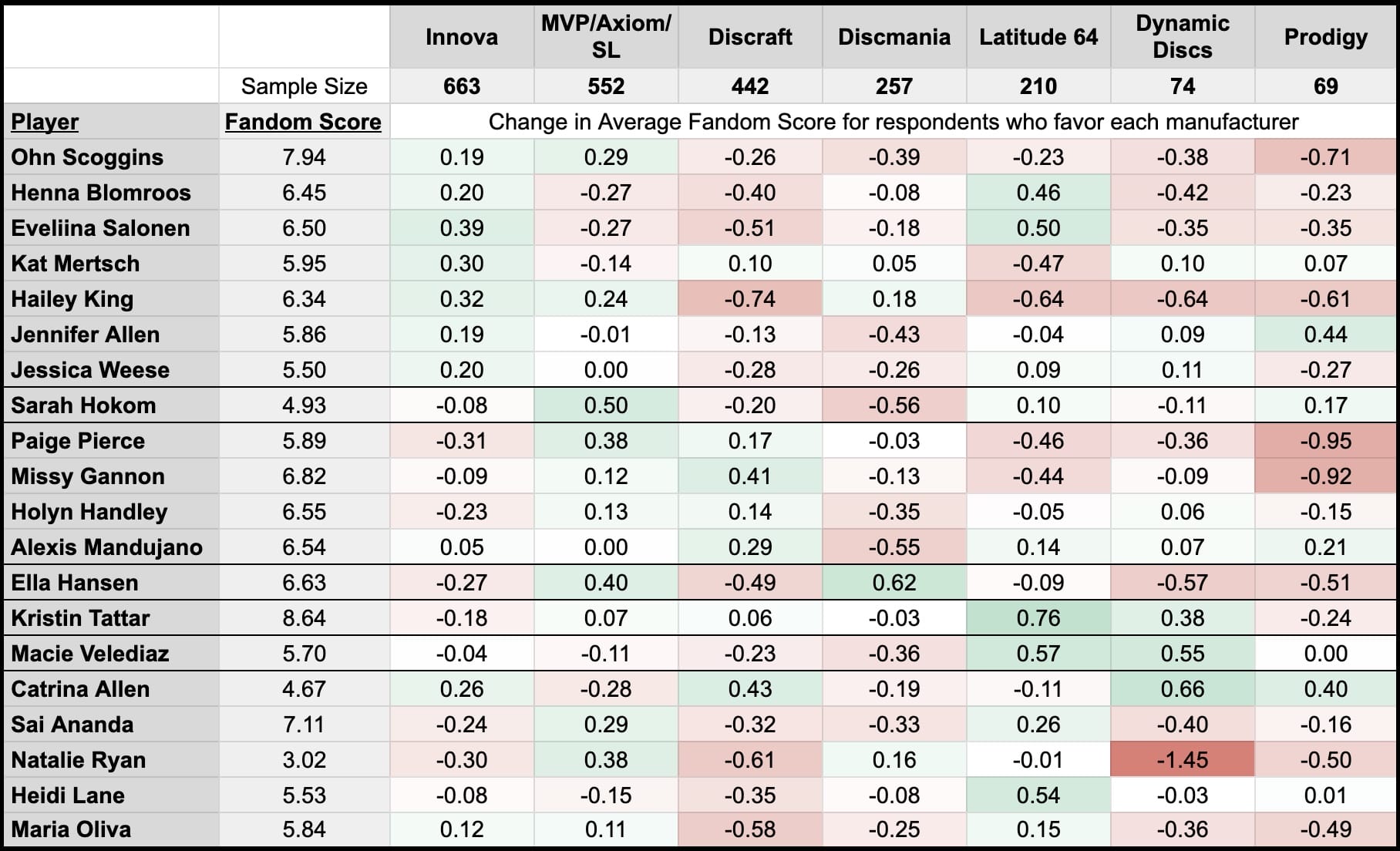

- For FPO, we can see some of the same patterns that we saw with MPO.

- Generally, the positive preference gaps for FPO were not as large as for MPO. This could mean that respondents are less passionate or polarized about FPO players.

- However, Natalie Ryan had the largest negative preference gap of any player, which came from fans of Dynamic Discs. She had a very low average Fandom Score to begin with, so having such an outlier negative preference gap is interesting. She has no ties to Dynamic Discs so why would Dynamic Discs fans dislike her that much more than the fans of other manufacturers? Perhaps this is just a result of the small sample size (74).

- McBeth and Pierce are often spoken of in the same conversation because they dominated the same period of disc golf. They are also the highest paid players of their gender in the sport (as far as we know), are both sponsored by Discraft, and are the main faces of the brand. Pierce is a free agent coming off an injury that kept her out for much of the 2022 season and has been a focus of some intriguing FPO offseason sponsorship discussions. Whereas McBeth had a very high preference gap from Discraft fans (1.48), Pierce had a very low preference gap (0.17). Interestingly, Pierce had a higher rating bump from MVP fans than Discraft fans.

- Fans of Pierce’s former sponsors (Prodigy and Dynamic Discs) gave her decidedly negative preference gaps. Hailey King received a very negative score from fans of her former sponsor (Discraft).

- There were a few players who, like Pierce, received higher fandom scores from other manufacturer’s fans. Ohn Scoggins was more popular with MVP fans than Innova fans. Jennifer Allen was preferred by Prodigy fans over Innova fans. Both Henna Blomroos and Eveliina Salonen were preferred by Latitude 64 fans over Innova fans. Innova sponsors by far the most top FPO players. Perhaps this waters down the passion of fans to root for specific team members.

- Tattar had the largest preference gap, which is all the more surprising because she had a very high average Fandom Score. This means that nearly all Latitude 64 fans gave her a 10.

Thank you for reading this lengthy piece. My thanks to Karl Lamothe and Josiah Zoodsma for their assistance in editing this piece as well as the rest of the StatMando team with data analysis and preparation. Special thanks go out to Josiah who reimagined the heat maps and made them 172.8% more understandable. Once again, if you wish to be notified when next year’s survey is ready or want to be emailed when survey results are released, please enter your email address here. If you are interested in being involved in the survey and have experience in polling or a profession related to studying surveys, please get in touch with us at [email protected].

Please see the full series of 2023 articles by following these links:

- The Survey Itself & Who Took It

- Which Pros Do We Root For and Against

- How Fans Feel about Disc Manufacturers

- Fans Relation to Discs: Coming This Offseason

- How Fans Feel about Media and Commentators: Coming This Offseason

- How Fans Feel about Courses: Coming This Offseason

- More Findings From The Fandom Survey: Coming This Offseason

Links for the 2022 Fandom Series articles can be found here.